Articles

If you’re inside otherwise close a well-known city or any other traffic appeal Homepage , you can drum up a lucrative side hustle as the a tour publication. Providing you know very well what the room is offering and also you’re also willing to spend time demonstrating tourists up to, this really is your own fantastic possibility. Leasing out a space or all of your home to differing people to own each week or a sunday will be a worthwhile top hustle with repeating earnings each month. So you can guess the new monthly earning prospect of your individual place otherwise a complete house, here are some these types of calculators out of on line home leasing marketplace Airbnb otherwise VBRO. You could potentially want to create you to-on-you to definitely education, you can also helps classification lessons and make more money for every hour. Some features can be found where you can join as the an animal sitter, along with Rover, Bring and Care and attention.com.

Which work usually requires expertise in servers and you can mathematics, because always entails carrying out search and you can taking a look at analysis. Ways to get customers are marketing with assorted companies, along with florists, lodge executives, professional photographers, DJs and you will caterers. You may also do social media pages linked to your front side hustle.

Homepage – Old age considered and preservation

If you have an amusing writing design that may cause people to laugh or even the power to share emotional advice in the conditions, you will probably find are a greeting card writer a lucrative front side hustle. Although there may not be far need for jump homes while in the winter, other seasons — specifically through the spring season and you may june — is perfect leasing times. Print upwards team cards and get the owners or professionals from wedding shops, drapery studios, inactive cleaners and you will dresses boutiques close by to mention your on their users when possible. Since you work with various other subscribers, you can even gain additional business, for example to make clothing.

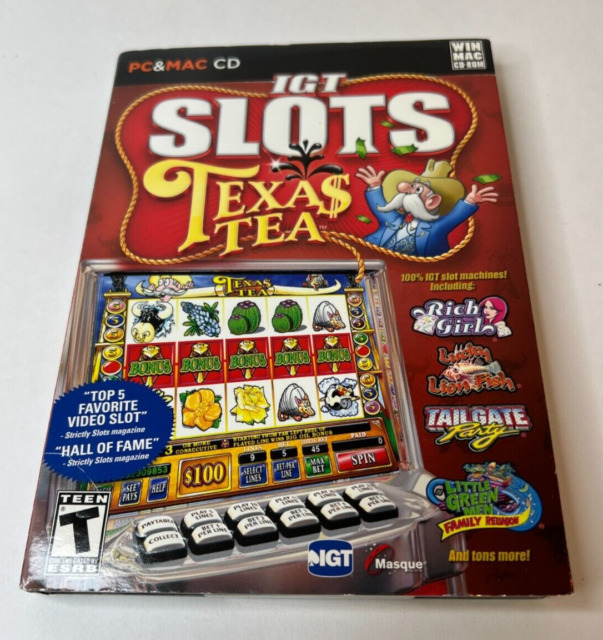

Almost every other Free to Gamble Booming Games Ports Machines on the Added bonus Tiime

Infant boomer riches grew easily anywhere between 1996 and you will 2014, with increased more than $34 trillion round the everyone on the child boomer age groups. The child boomer inhabitants along with reduced by the over 5 million while in the this time around. That it designed one, with a much bigger total wide range and a smaller sized population inside so it generation, the typical infant boomer’s money grew out of $127,640 inside the 1996 so you can $611,221 in the 2014. Your retirement entitlements owned by seniors are worth $ten.29 trillion compared to $step one.42 trillion owned by millennials.

He told penciling from the genuine can cost you away from higher expenses on the your financial intend to make sure to can be it really is pay for them. Gennawey said timeshares are good a way to manage recollections having enjoyed ones, nonetheless they acquired’t reduce your traveling expenditures, do lasting earnings or build your a lot of time-label money such as a diversified portfolio away from ETFs or mutual financing. Listed here are seven resources from financial experts to assist pick indicates you’re also throwing away cash in senior years and be something to.

Company Insider reports one boomers is ten minutes richer than millennials. We’lso are going to investigate as to why the brand new millennial compared to. boomer generational wealth gap is indeed extreme, and you may just what issues features triggered it. Since the 76 million seniors walk into old age, above 1 / 2 of, considering certain estimates, do not have sufficient currency to last in their old age. Of several seniors has resigned on the team, however you may not be able to give using their paying habits.

Playing with historical rising prices prices, one to number matches a great deal of $551,279 inside now’s well worth. Contrasting Generation X and you may millennials, the information shows that millennials are a dozen.5% bad away from than simply Age group X regarding riches obtained up to an identical many years. By the time Generation X was in their 30s, that they had the typical wealth of $122,999 (inflation costs taken into consideration), while you are millennials had the average wealth of $108,500. The data less than reveals the typical money for every generation over the years.

In-Depth Look at Game Provides

The fresh 2021 yearly exception number is actually $15,100000, definition men does not face fees if your gift is actually one amount otherwise lower. If the matter is more than $15,000, the individual giving the present need document a gift tax come back for the Internal revenue service. They’lso are already aged 24 and you can under, which means the majority of them haven’t yet inserted the brand new staff. Thus, we can’t expect them to have gathered greatly wide range. However, its parents (mainly Gen X) have been in the brand new team for some decades which means features got more time to pay off debt while you are making, rescuing, and you can paying their money.

Must i put that have Bitcoin playing Kid Bloomers?

It is best to make certain you satisfy all regulatory conditions ahead of to experience in almost any chose gambling establishment. Ports Urban area is actually a bona fide money internet casino which is known to enhance the online game because of songs and you may graphics. So it position is not in any way some other because and it has certainly one of Slot Urban area’s best on line demonstrations. You are considering a real possible opportunity to victory more in the long lasting, making this slot one of the most beneficial online slots games. The new perks are cool as well, an important basis for ranks best local casino online slots. The typical child boomer got a wealth of $140,346 in their 30s, 25% more than the newest insightful millennials inside the same decades.

“Really family members spend a fixed amount to its savings and you will purchase the others — which is the way they afford large and you can larger property while they deal with offers as well as their shell out enhances. However,, it’s much more strong, financially talking, to store everything and you may improve your chosen lifestyle can cost you. Tack on the inflation, high medical care will set you back and you can extended existence expectancies, and boomers abruptly may be effect reduced safer about their financial position — and less nice with regards to offering currency away. But, for the present time, well-done, er, condolences for the millennials.

And you will deposit the bucks your help save on the a savings account to find a start for another year’s Xmas imagine. Which have a Christmas time on a budget setting are prepared to rating innovative for the ways you purchase your bank account along with your date. Including, instead of paying for escape amusement otherwise travel, see conditions that can help you together as the pupils you so you can of course don’t can cost you any money anyway. Age group Jones, otherwise GenJones, refers to baby boomers produced on the U.S. in the decades 1954 to 1965. The word try created by the writer Jonathan Pontell whom retains you to such after boomers will vary enough from their very early boomer competitors in order to make-up their particular generation.